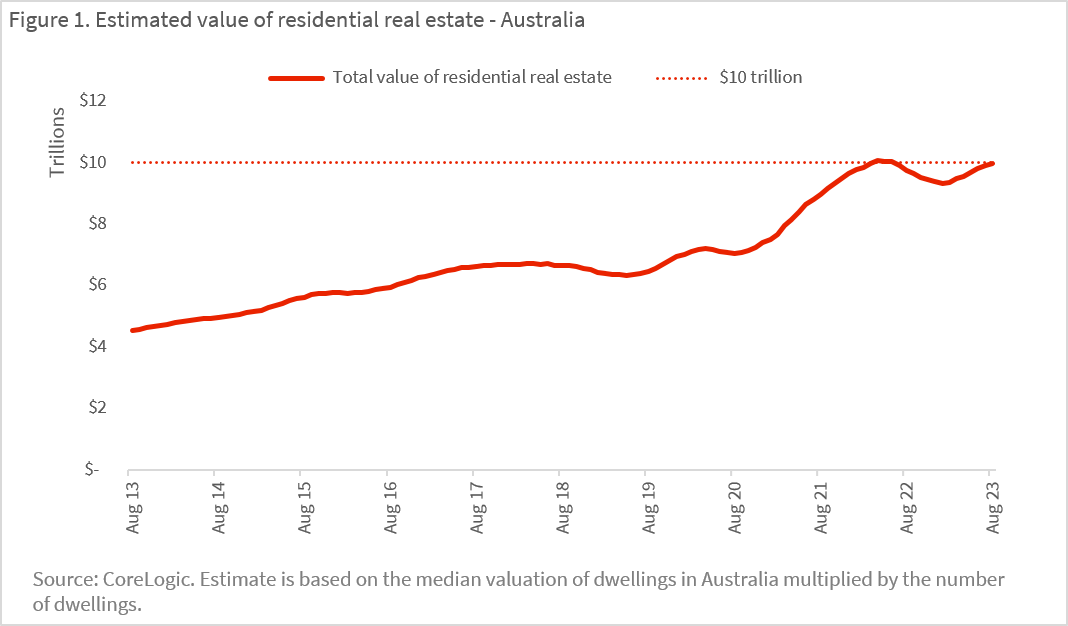

The combined value of Australian housing rebounded to $10 trillion at the end of August, the first time the total estimated value hit double digits since June 2022.

The increase resulted from a combination of higher values, with the median home value in Australia reaching $732,886 at the end of the month, and the stock of housing increasing to around 11 million properties.

The national recovery in home values began in March this year, with values rising 4.9% through to the end of August. This recovery has wiped out around half of the preceding downturn between April 2022 and February 2023, when national home values fell -9.1% peak to trough. Home values are now just -4.6% from the peak in April 2022.

The recovery trend in values comes despite a cost of living crisis, low consumer sentiment levels and four increases in the cash rate so far this year amid the fastest rate hiking cycle on record. It begs the question, how is this possible?

There are a few factors that may explain why housing values have continued to rise, despite seemingly unfavourable growth conditions:

1. Net overseas migration.

Demand for housing is being pushed higher by a combination of returning overseas arrivals, and a drop off in overseas departures. Last year, departures from Australia were down about -25% on the pre-COVID average, while overseas arrivals ticked slightly higher on levels seen in 2019. Combined with a persistently low average number of people per dwelling across the capital cities, this is pushing the need for housing higher, and may be contributing to more competitiveness for properties on the market, especially considering rental vacancy rates remain around record lows.

2. Use of savings, profit and equity.

There may be some draw-down in savings, equity or profits from previous home ownership that is being used towards property purchases, as opposed to more borrowing. This would also help to explain why home values have continued to rise in the past few months, as ABS reported a fall in the value and volume of lending through June and July. However, it is uncertain how long households can draw on savings to support purchases. ABS national accounts data shows the household saving ratio, which measures the ratio of net saving to net disposable income, has declined to 3.7% amid high inflation and debt costs. This is down from COVID-record highs of 23.6%.

3. Constrained supply.

Total listings volumes remain fairly low, even as new listings have started to increase in the lead up to the spring selling season. In the four weeks ending September 3rd, total listings across Australia were sitting at around 136,000, which is -23.4% lower than the previous five-year average.

Can the recovery continue?

Although housing values have been consistently rising over the past six months, the housing market outlook remains highly uncertain. While there is a growing expectation that the RBA board is done hiking the cash rate, borrowing remains constrained by a relatively high serviceability buffer. APRA data to June showed the weighted average home loan assessment rate was just below 9%, and ABS housing lending data shows mortgage lending has fallen for three of the past four months.

Economic performance is also set to unwind, and while this is good news for the inflation and cash rate trajectory, a rise in unemployment may create a higher degree of risk for mortgage serviceability. CoreLogic is expecting some heat could come out of the recent recovery trend toward the end of this year, while a more robust recovery in housing values will be limited until credit conditions loosen.

*This post was originally published on https://www.corelogic.com.au/news-research/news/2023/the-value-of-australias-housing-market-just-hit-$10-trillion-again.-how-is-this-possible?utm_medium=email&utm_source=newsletter&utm_campaign=au-rea-property-pulse-2023-sep