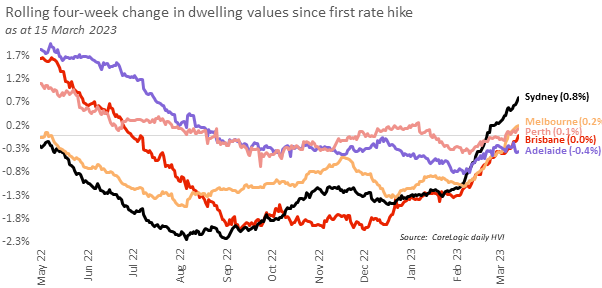

The momentum in Australia’s housing downturn has been easing since September 2022, with value falls virtually flat lining in February. Sydney led the change as housing values recorded their first month-on-month rise (+0.1%) since January last year.

This positive momentum has carried through the first half of March. CoreLogic’s Daily Home Value Index (HVI) is up 0.3% across the five largest capitals through the month-to-date:

- Sydney housing values are 0.5% higher over the first 15 days of the month

- Melbourne and Perth are 0.2% higher

- Brisbane housing values are flat (0.0%)

- Adelaide has recorded a subtle fall over the same period (-0.2%)

On a rolling four-week basis, which provides a useful proxy for monthly change, Sydney (+0.8%), Melbourne (+0.2%) and Perth (+0.1%) are all recording a lift in values. Brisbane remains unchanged over the past four weeks, and Adelaide is now the weakest of the five largest capitals with values down -0.4%.

Lack of new listings

The return to a more positive trend in housing values has occurred alongside a persistently lower than normal flow of new listings coming on the market. CoreLogic reports capital city listings over the past four weeks were 19.9% below the previous five-year average for this time of the year. Such low advertised supply is likely to be a central factor keeping a floor under housing prices despite a clear drop in demand. At the same time, we have also seen a rise in auction clearance rates back to around the decade average.

Overseas migration on the rise

The surge in permanent and long-term migrants could be another factor supporting the stronger market conditions. While most of the housing demand from overseas migration is likely to flow into the rental market, with vacancy rates so tight, we may be seeing a higher than normal portion of long-term or permanent migrants choosing to buy rather than rent.

Bottom of the cycle still to come

However, the housing market is still facing some considerable downside risk. With this in mind, it’s still too early to call a bottom of the cycle. Interest rates may rise further from here, as well as the fact that we are yet to see the full impact on households from the aggressive rate hiking cycle to date. Additionally, economic conditions are set to weaken through the middle of the year, as household savings buffers are being depleted and labour markets are likely to loosen further.

One of the key metrics to watch will be the flow of new listings coming on the market. Any sign of a larger than normal level of freshly advertised stock could signal that prospective vendors aren’t willing or able to wait out the downturn any longer. A rise in advertised supply to above average levels could be a signal this recent trend of growth has run out of steam.

Given the uncertainty ahead of us, the next few months will be critical to understand whether the housing market is indeed moving through an inflection point or if it is simply the eye of the storm.

*This post was originally published on https://www.corelogic.com.au/news-research/news/2023/positive-trend-for-housing-values-through-first-half-of-march-but-bottom-of-the-cycle-could-still-be-ahead?%20utm_medium=email&utm_source=newsletter&utm_campaign=20230320_propertypulse