Queensland’s build-to-rent pipeline has more than doubled in the past year, driven by aggressive acquisition strategies from major players who have been scaling up.

While Victoria dominates Australia’s build-to-rent pipeline with 60 per cent of stock, both operational and in planning or construction, Queensland’s pipeline has grown significantly to now be well ahead of NSW.

According to property advisory firm Charter Keck Cramer, there are about 1150 build-to-rent apartments approved and preparing to break ground and a further 1000 apartments in planning in the city’s inner and fringe regions.

The most active region for apartment development in metropolitan Brisbane has historically been the city fringe region, due to its supportive planning controls as well as the proximity to, and views of, the Brisbane River and CBD.

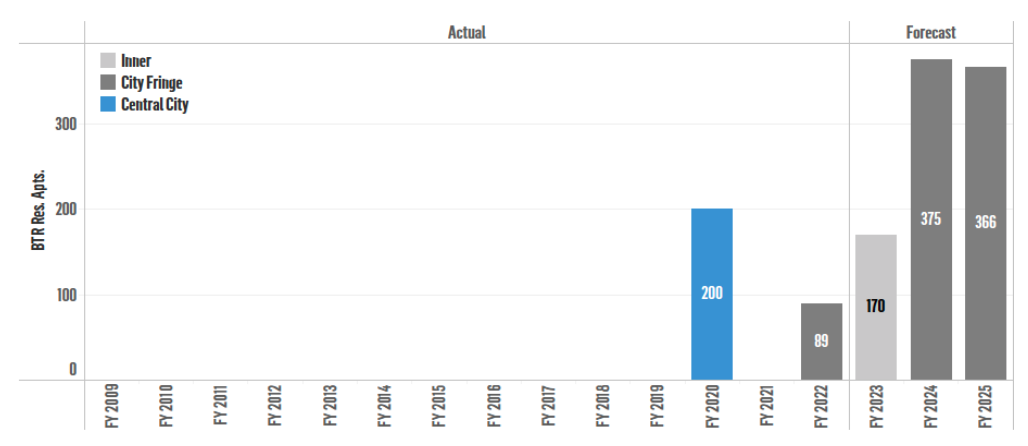

There were 200 apartments in one project completed in 2020—which has been sold in one line to an international build-to-rent operator and is now operating—as well as 90 apartments in a further project completed this year.

Charter Keck Cramer director of research Richard Temlett said given Brisbane’s strong underlying fundamentals, the build-to-rent market had the potential to emerge and become entrenched over the next decade leading up to the Olympics in 2032.

“As the value proposition of build-to-rent becomes fully understood by the renter market, it is anticipated that the rental premium will become materially greater than standard build-to-sell apartment rents,” Temlett said.

“With over 35 per cent of the population renting in Brisbane there is a substantial opportunity for build-to-rent to supply rental accommodation that will be unable to be supplied by the build-to-sell market in the short to medium-term.”

Completions over time, Metropolitan Brisbane

Major existing build-to-rent developments include Mirvac’s 395-apartment project at 60 Skyring Terrace in Newstead, being delivered under the Queensland government’s $70 million build-to-rent program and Frasers Property’s 366-apartment project, Brunswick and Co, at 210 Brunswick Street in Fortitude Valley.

Within Brisbane’s build-to-sell market there have been 1000 apartments launched this year, the lowest number of launches recorded over the past decade and was 93 per cent lower than the peak of 14,300 apartments in 2015.

The increase in population in Brisbane throughout the pandemic has absorbed the oversupply of build-to-sell apartments from the 2018 peak causing vacancy rates to tighten to 0.7 per cent and rents to skyrocket.

Temlett said Brisbane remained on track to be the fastest-growing city in Australia for the next two years before building towards the 2032 Olympic Games.

“Given the strong underlying fundamentals, the build-to-rent market in Brisbane has the potential to emerge and become entrenched over the next decade leading up to the Olympics in 2032,” Temlett said.

Meanwhile, there were 1900 build-to-sell apartments completed in 2022, an 84 per cent decrease from the peak year of 2017 when 11,600 apartments were built.

Developers in Queensland are yet to receive further encouragement to enter into the build-to-rent market with the absence of tax concessions, reduction in land holding costs that are being offered in other states.

The now $9.6-billion build-to-rent sector was given a boost in 2020 by specifically targeted land tax reductions in NSW and Victoria.

In Melbourne, supply shortages, higher inflation and rising interest rates have provided a near-perfect platform for the emerging build-to-rent sector.

There have been 570 apartments in two projects completed this year so far with a further 1900 apartments across six projects forecast to be completed over the next two years and 8000 apartments in 22 projects that have been approved.

The city currently has one operational project, Home Southbank at 256 City Road, which began renting apartments at the beginning of May this year and now has 1900 apartments across six projects forecast to be completed between 2023 and 2024.

By comparison, Sydney has 850 operational build-to-rent apartments and 1200 in six projects forecast to be completed between 2023 and 2025 and a further 2750 apartments in nine projects that are under assessment.

The emerging sector does face headwinds. Build-to-rent was on track to account for 12 per cent of all new high-density housing starts by next year, but is now facing an uncertain outlook beyond 2023 as construction and borrowing costs have risen.

The attached housing market is also bouncing back. The latest official figures show new apartment approvals have surged over the first half of the year.

*This post was originally published on https://www.theurbandeveloper.com/articles/brisbane-build-to-rent-pipleine-charter-keck-kramer-apartment-market-research-2022?utm_source=TUD+-+Daily+Briefing&utm_campaign=82403d8ca2-EMAIL_CAMPAIGN_2021_08_11_01_49_COPY_01&utm_medium=email&utm_term=0_982c36d415-82403d8ca2-195663826