John McGrath – Time to Shine For Brisbane & Surrounds

It’s no surprise that for the fourth consecutive month, Brisbane has outshone the other East Coast capital cities and recorded the highest month-on-month median home value growth, according to new CoreLogic figures for the month of January.

It’s also the fourth consecutive month that the Sunshine State’s capital has recorded more than 2% growth. Regional Queensland, which incorporates the exceptionally strong markets of the Gold Coast and Sunshine Coast, has also recorded about 2% price growth since October as well.

The new year began very positively for Brisbane, with home values up 2.3% in January compared to Canberra 1.7%, Hobart 1.2%, Sydney 0.6% and Melbourne 0.2%.

As you can see, home values continue to rise across the East Coast capitals but the rate of growth has slowed in Sydney and Melbourne, largely due to an increase in the number of homes for sale.

Conversely, supply is still very tight in Brisbane with stock on market currently 47% lower than the 5-year average for the city.

Brisbane and surrounds have been overdue for a strong run of price growth for a few years. Consider the lifestyle benefits – with possibly the best warm climate in Australia and pristine beaches and waterways everywhere – then look at the value on offer.

The median house price in Brisbane is $810,000 compared to Sydney $1,390,000, Canberra $1,032,000 and Melbourne $1,002,000. (As you’d expect, Hobart is much cheaper at $760,000.)

This price gap indicates there is potentially much more room for capital growth in Brisbane this year compared to the other East Coast capitals.

South-East Queensland will undoubtedly continue to benefit from pandemic trends – the most impactful being the now commonplace opportunity to work from home. When you can do that, you can essentially live anywhere and South-East Queensland allows buyers to upgrade their lifestyles while downgrading their mortgages. What a win-win.

Future drivers for capital growth are also very strong, including 10 years of pre-Olympics infrastructure projects ahead – not only in Brisbane but also on the Gold Coast and Sunshine Coast where many events will be held – and increasing interest from overseas investors.

And what about investment? Not only does the Brisbane and surrounds market offer great comparative affordability, but it also offers better rental returns than the other East Coast capitals.

If we focus on typical investment stock – apartments – gross yields in Brisbane are 4.8% compared to 4% in Hobart, 3.5% in Melbourne and 3% in Sydney (and they’re on par with Canberra at 4.9%), according to CoreLogic data.

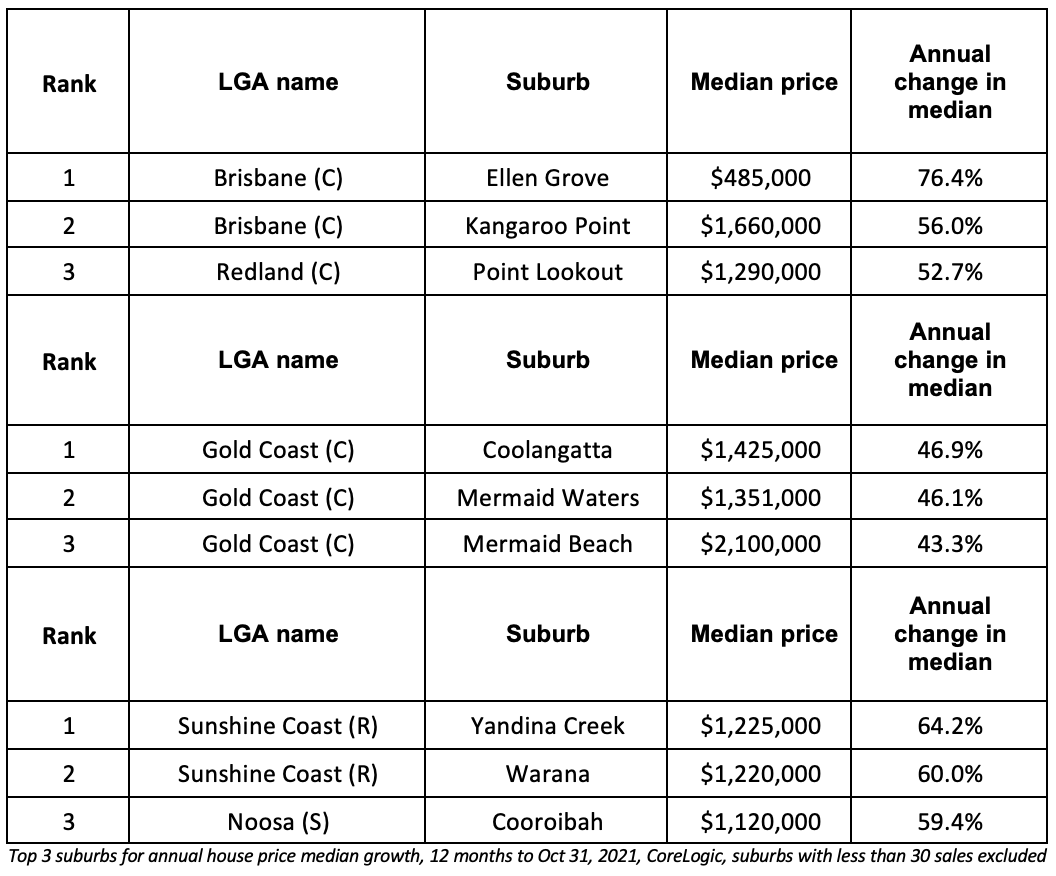

The suburbs benefitting the most from surging buyer demand in Brisbane and surrounds are:

If you’re looking for an affordable lifestyle change or an attractive long-term investment, I think you’d be hard-pressed to beat South-East Queensland in 2022.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.